1. Introduction

In 2007, Valentin Dominte was in high school, and he certainly did not follow news about how bureaucrats in the European Union were voting. Unbeknown to him, a quiet financial revolution started in Brussels that year, one that would later be significant for his software developer career, for fintechs all over the continent, and for every EU citizen’s money: open banking.

In simple terms, open banking is a way for people to take back control of their financial information. Like Valentin, you might have two or three bank accounts, each with its own app and its particularities for making transfers, checking the balance, or granting a loan. If you wanted to have an accurate overview of your finances, you’d need to log in to each of those bank apps, extract the information and do all the calculations yourself. Open banking breaks down the walls between all of these different apps, making it possible for apps to pull information from the accounts you choose and give you real-time information about your finances that is gathered from all of them.

Technology is at the heart of open banking. At Levi9, Valentin Dominte is one of our most experienced developers working in open banking since 2018, and we’ve asked him to give us his insights into this topic.

“The official definition of open banking is the process of enabling third-party payment service and financial service providers to access consumer banking information such as transactions and payment history through APIs,” says Valentin. Some key expressions he highlights are third-party payment, consumer banking information, and APIs.

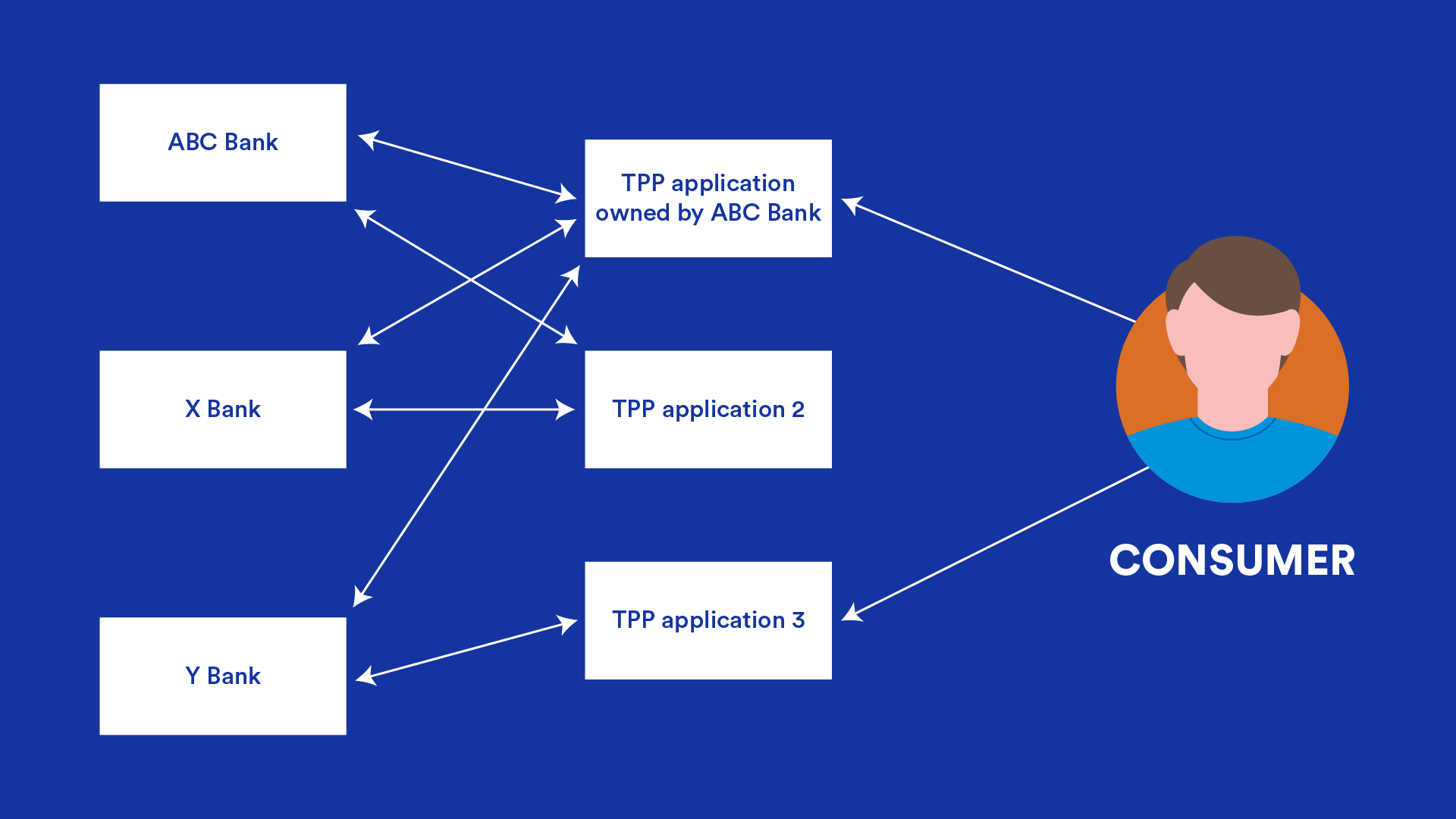

“A third party is a service that aggregates that data,” explains Valentin. “It can be an application from one of your banks, but it can also be completely independent, and you can have different third-party providers for different use cases.” The main benefit for the consumer is that they can get information in a way that is easier to use.

Some of the consumer banking information that can be accessed through open banking includes the account holder’s name, the account type (current, savings, etc.), and information about transactions (amounts, merchants, etc.).

APIs are at the heart of open banking, serving as a bridge between multiple financial services. Through APIs, different systems can talk to each other in a standardized way, meaning that developers can use them to build new features or services on top of existing systems. One important feature of APIs, especially in open banking, is that information is shared in a standardized and secure manner.

2. The EU regulations on open banking

Perhaps Valetin did not pay attention to EU open banking regulations in high school, but looking back he says that the concept of open banking in Europe is tightly linked with those regulations known as PSD (Payments Services Directives).

The first PSD was released in 2007, with the EU Commission seeking to stimulate competition in the financial industry, enhance the quality of services provided, and protect the end user.

A second version of the PSD was released in 2015, introducing the concept of consumer protection against bank or third-party providers. “The focus now was on the end-user experience and privacy.” Two main concepts were enforced by this PSD2 directive: the first — strong customer authentication. “Basically that means as a bank you shouldn’t allow people to connect to your API without multi-factor authentication, let’s say. And the end user should have the same way of authenticating directly to the bank or through a third party. There should be no difference.” A second concept was related to the fact that third parties should connect to banks in a standardized manner. Third parties are also obliged to register with an authority, adding another level of security.

Valentin says he is now keeping an eye on discussions related to a third directive. While following EU legislation might not be typical everyday work for a developer, Valentin builds a strong case for remaining one step ahead and analyzing the impact of legislation on technology.

3. How screen scraping became obsolete

To prove this point, Valentin reminisces about one of his first projects in open banking. Before APIs became the norm and before strict European regulations, developers were still looking for ways to let users access their financial data in a more friendly manner. “Because developers are creative and can find workarounds, there is an alternative to APIs: screen scraping.”

Screen scraping imitates what a person does on a portal, doing everything automatically that a person can do by hand. “It meant impersonating the client in the bank portal to extract data or perform action. Screen scraping solves the issue of missing APIs, but it introduces several other problems.”

“With screen scraping, the third-party provider controls how the consumer’s credentials are stored and secured,” warns Valentin. Moreover, the clients don’t get to choose what information they share but rather have to give full access to the third-party provider. On top of that, screen scraping cannot get around multifactor authentication and could trigger a possible violation of terms and conditions. Developers avoid screen scrapers not just because of security concerns but also because “this kind of integration is quite fragile.” What if the UI of the internet banking system changes for some banks? The third-party has to adjust to those changes each time.

Coupled with EU rules, the technical setbacks were the main reason that screen scraping became an obsolete practice.

4. How open banking breeds innovation

Open banking is a breeding ground for new ideas, and it encourages innovation by chipping away at large bank monopolies. “Third parties can provide a better user experience and steal the show, which should result in lower costs and, hopefully, a better experience for the end user,” says Valentin Dominte.

Saving time for customers

One way that open banking is different is by making it easier for customers to get loans. “For one of Levi9’s customers, we developed a system that saved the bank and its clients a significant amount of time. When applying for credit, clients had two options: one was to manually upload proof of their financial situation, such as salary slips, bank statements, rent agreements, or mortgage contracts. The second one was to log into the bank account, and choose which transactions represent income or housing costs.”

One immediate result was an improved customer experience. “The customers didn’t need to look for salary slips or dig around for their mortgage contract.” At first, about 40% of customers were unsure about sharing their information automatically with the bank. However, over the course of three years, the number of customers using the faster way to log in to the bank increased by a factor of ten.

Instant credit limit

In a second open banking Levi9 project, Valentin and his team replaced cumbersome manual steps and questionnaire filling with instant credit limit calculation. “We had the old system and the new, automated system run side by side. When clients applied for credit, they were randomly assigned to one of the two systems. Some were going the old road of filling out a questionnaire, providing proof of income and expenses, and getting their answers manually assessed by a bank employee. But other customers had a much more straightforward experience, thanks to the Levi9 project: they simply logged into their bank account, their transactions were automatically analyzed, and they were able to receive their credit limit on the spot.”

With standardized communication between services through APIs and clear regulations, open banking is the perfect playground for technological innovation.